Options trading in at the deep end can be quite overwhelming – especially when you really have no experience or prior knowledge. Binary options trading is no exception.

Many interested people do not know where to find out more and what steps to take to start trading.

We will show you how trading with binary options works and what you should consider as a beginner.

What are binary options?

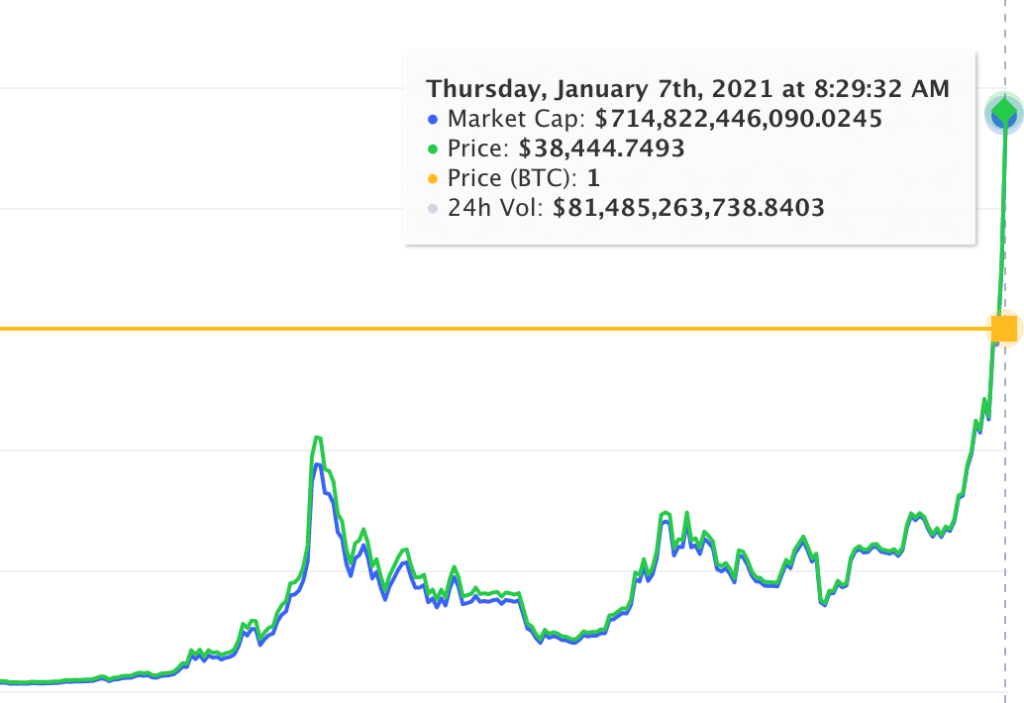

Binary options are a specific type of speculative trading in currencies, stocks, commodities or indices. The name comes from the fact that only two scenarios can occur as a result of such a trade – a binary yes or no answer, so to speak.

When a certain event occurs, the trader is paid a fixed profit. Otherwise, the invested sum is completely lost. So, in short, it is a form of fixed return financial options.

One of the biggest advantages of binary trading is that it offers high returns compared to other trading options. Because this form of futures trading is an all-or-nothing concept, binary options trading is profitable when the prediction turns out to be correct.

Professional trading with binary options has become increasingly popular in recent years, but trading in financial derivatives can also be interesting for beginners.

How exactly does binary options trading work?

You need a broker to trade binary options. When trading on a stock exchange, these financial service providers act as brokers for the offers.

But there are also options traded outside of exchanges. In this case, transactions take place through other trading platforms or online brokers.

Call vs Put

When trading binary options, you buy a so-called call when you bet on an asset’s price increase. A put is a bet on a falling price.

So that money can then be made with a call, the market must be quoted above the strike price on the expiration date – and vice versa for a put.

How should beginners go about trading binary options?

When trading binary options for the first time, beginners should follow these five steps:

- Know the market trends.

- Choose the market you want to trade carefully.

- Specify a base price and the end of the term.

- Place your trade.

- Wait for expiry or close your trade early.

Is binary options trading risky?

Binary options allow traders to take advantage of price fluctuations in several global markets. However, it is important to know and correctly assess the risks and opportunities.

The risk you take when trading binary options should only be a small percentage of your total trading capital. Professional traders typically use a maximum of one percent of their capital per transaction.

How do you find the right broker?

There are a few points to consider when choosing a broker:

Pay attention to what type of assets the broker is offering. You should be able to trade a variety of assets including stocks, commodities, and currencies.

Make sure the broker offers a good platform to trade on. The interface should be intuitive to use and help you trade effectively. Some brokers like Binomo also offer trading app for PC or Androide devices, https://www.hackamericas.org/en/how-to-download-binomo-app-for-pc-and-android-apk/ you can download the app for free.

Check what kind of customer service the broker offers. You should be able to get help quickly and in your local language.

Conclusion: binary options trading

Trading with binary options is transparent and offers clearly defined risks and results – for beginners and professionals alike.

It reflects the way people normally think and weigh the relationship between opportunity and risk in their daily lives.

With binary options, the latter is limited to the amount you wager on a single trade.